This is the second post in my remote work series. Please see the first article listed below.

One thing that people always point to as a reason bosses want people back in office is “they just signed these big expensive leases.” What most people don’t know is, we have the data for that. And that we wouldn’t have had the data if Covid had happened just two years earlier.

I’ll try to to keep from getting too far into the technical accounting. Essentially, in 2019 the accounting rules changed. The old rules only said that companies only had to show their lease expenses on the income statement, essentially how much they paid for rent each month, easy peasy. The new rules are a bit more complicated but they basically say hey, you signed a 30-year lease. You don’t just have one month of rent, you owe someone for the next 30 years. Since you owe them, it’s debt. It’s a liaiblity, and you have to put it on the balance sheet along with all the other money you owe people. You can’t just not count that one anymore.

This went through a few years of delays, commentary, and review, but despite push back it was enacted into law for public companies in “the financial year starting after December 15, 2018”. For most companies, that’s January 1st – December 31st 2019. But if you’re funky like I discovered Apple is and end your fiscal year on the last business day in September…it’s the one after that. Okay let’s not get distracted by weird calendars, let’s just say 2019 financials and agree that’s when all public companies had to start reporting this data. Also to clarify, public companies means any company publically traded on a US stock exchange.

This has been in the back of my brain for almost 5 years now, so I decided to start pulling this data. Public companines all publicly file thier financial information, so it’s availble for anyone to go look at. I quickly found that while most internet finance sites do have summary information on financials, to get the specific line items I wanted to look at, I had to go pull the documentation. Copies of these documents are typically found on the investor relations page of a given company’s website, or you can pull them directly from SEC databases.

I decided to start with FAANG companies and look at data for the past 5 years. I only made it as far as Google and Apple, before my fiance asked me if I thought those tech companies were truly reflective of the market. My background of living in the bay area and working in startups meant that yes, I considered these companies thought leaders whose decisions drive the market. He thought that they get a lot of publicity but might not be the most reflective of the overall RTO vs Remote work debate. (Sidenote, I strongly encourage everyone to find a partner who can challenge you intellectually, we both consider the other to be the smarter one since we see the world through different lenses).

All this to caveat, maybe these aren’t the right companies to look at. But the data for the first two was so intriguing that I wanted to share them indivudally.

I pulled the below line items from different sections of Google / Alphabet’s 10-K documents – thier annual financial statements. I summarized the two lines for short-term and long-term lease liabilites to show the total lease liability. This roughly offsets the operating lease asset line, but they’re never exactly the same due to some pesky math we don’t need to get into.

Note on table – Operating Lease Expense comes from Footnote 4 to the financials. With the implementation of ASC 824, filers were requried to add a footnote, which is bascially more information and commentary on their lease spending than you can get from looking at the face of the financials alone.

My first impression of thes figures is that…they’re going up. The started going up in 2020 and have continued to increase. The increase in Operating lease liabilites means that Google has been signing new leases worth roughly $1B PER YEAR since Covid started. (These figures are in millions. $1,000 million = $1B). So yes, you’re reading that correctly, as of 12/31/2023 Google has $15B in active leases, amounting to $4.5B in rent payments in 2023, and a $2.4B increase from the end of 2020. This shocked me, I’d strongly expected these figures to go down. It also strongly confirms the argument that RTO polices stem from lease costs. Google isn’t even the harshest RTO employer at the moment, that title currenly goes to Amazon. However, a quick Google search (lol) shows a myriad of links to articles that employees remain wary. The most recent one is a Business Insider article, which is behind a paywall but the headline alone is very telling. From what I could find, the current RTO policy is hybrid with 3 days a week in office, and has included badge-tracking.

Google Tells Staff: Stay Productive and We’ll Stay Flexible

Google – Leasehold Improvements

One other question kept nagging me as I went through this analysis is that there were other numbers I wasn’t considering. The one that bugged me the most is Leasehold Improvements, which is exactly what it sounds like. This is money a company as spent in improving the spaces they lease but don’t own. For example, my employer is currently going through an office remodel, and all of the related costs are considered leasehold improvements. (Yes, I’m in charge of this at my actual real job). Personally, I’m a fan of companies spending on leasehold improvements. If we’re going to be spending anytime at all in the office, let’s at least make it look pretty.

So I pulled the numbers down to see the trend. Between the end of 2020 and the end of 2023, Google spent almost $4B improving thier office locations. This could be related to new leases they signed to get the spaces ready for the employees, but would also incude any improvements to existing leased offices.

| (in millions) | |||||

|---|---|---|---|---|---|

| 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 | 12/31/2023 | |

| Leasehold Improvements (in Fixed Assets on BS ) | 6,310 | 7,516 | 9,146 | 10,575 | 11,425 |

Additional notes for consideration-

- Google both owns and leases their offices, so this isn’t reflective of their full cost of office locations.

- I considered if these lease costs were being driven by headcount. In financial statements, filer are required to disclose one number for Full-time equilavlent, or FTE employees. These figures were largely unchaged for both companies in the 5 year span, which impleas a strong reliance on contractors and hourly employees rather than indicating that their headcount has remained unchanged.

- I have no geographic information avaialbe for this spending, but it’s surely something that the companies are likely to track internally. It’d be interesting to know how this spend is broken down betwen new and existing offices, and where they’re located.

- This data is for all leases that Google has. This doesn’t just inculde office space, but could include other real estate such as data centers, equimpent such as copiers or cars, etc.

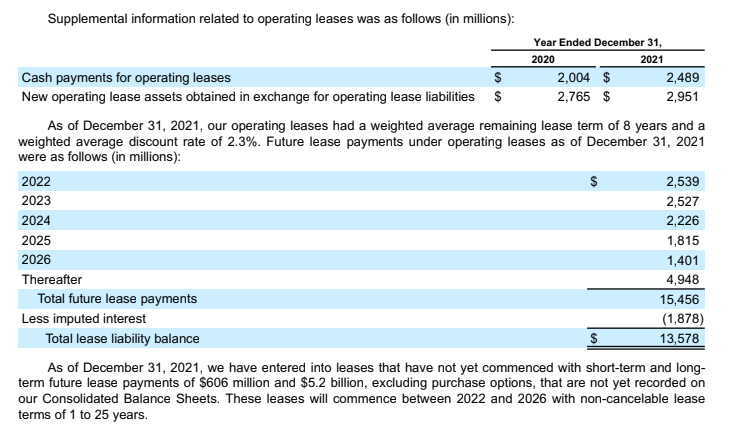

Supplemental Data for Google -Note 4. Leases from FY 2021 Fianancials

Please see below example of a lease accounting footnoote as required by ASC 842, from Alphabet’s 2021 10-K.

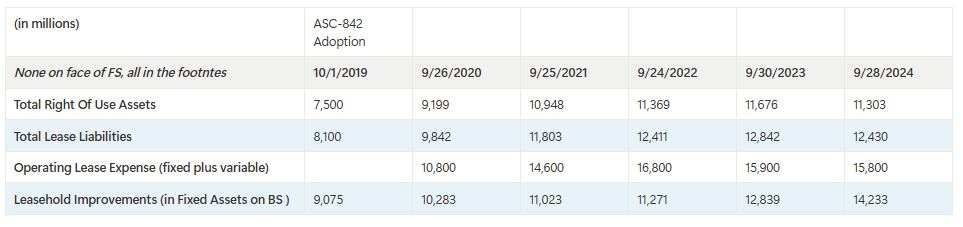

Apple

The data for Apple shows similar trends. As noted previously, they end their fiscal year on the last business day in September. I’m therefore able to included data for their year-ended 9/28/2024, while Google’s 2024 financials won’t be issued for a few months.

Between the year-ended 9/26/2020 and the year ended 9/28/2024, Apple’s lease liability has increased by $2.5B and amounted to $15.8B in expenses for 2024. They similarly show an increase in leasehold improvements of $5B for this time period.

In conclusion, for these two companies it’s a plausible argument that lease costs for office spaces could be driving RTO policies.

So, what do you think? Is spending on office leases driving the Return to Office movemnt, is it truly a desire for collaboration and increased productivity, or is it just micromanaging? Are there other companies I should look at that would be more reflective of the general market? Should I look at Amazon’s figures to see just how big the numbers are?

Very interesting.

Randy McKernan

Image Connection, LLC

7117 Crossroads Blvd

Brentwood, TN 37027

Direct 615-933-4581

Office 615-309-8250

http://www.imageconnection.nethttp://www.imageconnection.net/

http://www.progolfshirts.comhttp://www.progolfshirts.com/

LikeLike